Delaware Virtual Offices: How They Provide Legal Protection & Tax Savings for LLCs

When you think about where to start your business, Delaware might not be the first state that comes to mind. But for seasoned entrepreneurs and smart startups alike, there’s a reason why this small East Coast state is a giant in the world of LLC formation.

If you’re considering launching a company or expanding your presence, a virtual office in Delaware could be your best-kept secret for lowering taxes, protecting your personal assets, and boosting business credibility—all without ever leasing physical space.

Here’s a full breakdown of what makes Delaware virtual offices so powerful—and how Opus can help you take full advantage.

Why So Many LLCs Choose Delaware

You might’ve heard the stat: over 66% of Fortune 500 companies are incorporated in Delaware. But why?

- No state sales tax on goods or services

- Low franchise taxes for small LLCs

- Flexible corporate laws designed to favor business owners

- Delaware Court of Chancery: a unique business court system with expert judges and no juries

- No physical office requirement for LLC formation

Combine all of that with a virtual office—and you’ve got a lean, flexible business setup built for scale and protection.

What Is a Virtual Office in Delaware?

A virtual office provides a real business address—not a PO Box—that you can use to:

- Register your LLC

- Receive official mail and packages

- Set up business banking

- Build trust with clients and vendors

Opus Virtual Offices also offers add-ons like live receptionist service, mail forwarding, and meeting room access. It’s everything you’d get from a traditional office, minus the rent, utilities, and long-term lease.

Virtual Business Address Delaware: Why It’s Ideal for Your LLC

Can I Legally Register an LLC in Delaware With a Virtual Office?

Yes—and it’s actually the norm.

Delaware doesn’t require LLC owners to live or operate physically in the state. All you need is a:

- Registered agent with a Delaware address (Opus can help)

- Business mailing address for official correspondence (your virtual office)

This makes Delaware ideal for:

- Freelancers & remote workers

- E-commerce & SaaS startups

- Investors & holding companies

- Digital nomads who need a solid business base

Tax Benefits of Using a Delaware Virtual Office

Delaware is well-known for its business-friendly tax environment, especially for LLCs.

No State Sales Tax

Delaware doesn’t charge sales tax, which can lower your cost of doing business.

Low Annual Fees

You’ll only pay a flat annual LLC tax—no income tax on out-of-state revenue.

Privacy Protections

Delaware allows you to form an LLC without listing member names publicly.

This level of discretion combined with a virtual address makes it easy to separate your personal identity from your business operations.

Learn more from the Delaware Division of Corporations.

How Delaware’s Court of Chancery Protects LLCs

One of Delaware’s biggest advantages is its specialized business court, the Court of Chancery.

- Handles corporate cases only

- Judges are appointed based on experience, not election

- Decisions are made quickly and fairly—no juries involved

If your LLC ever faces a legal issue, Delaware’s system is faster, less political, and more business-friendly than courts in other states.

For serious entrepreneurs, that’s peace of mind.

Who Should Use a Delaware Virtual Office?

A virtual office in Delaware is ideal if you:

- Want a tax-friendly place to start or expand your LLC

- Operate 100% online and don’t need physical office space

- Value privacy and asset protection

- Are seeking investors or building long-term credibility

Even if you’re based in another state, you can still form your LLC in Delaware using a virtual office address. You’ll just need to register as a foreign entity in your home state if you also operate there.

Virtual Office Space in Delaware: What You Need to Know Before Choosing One

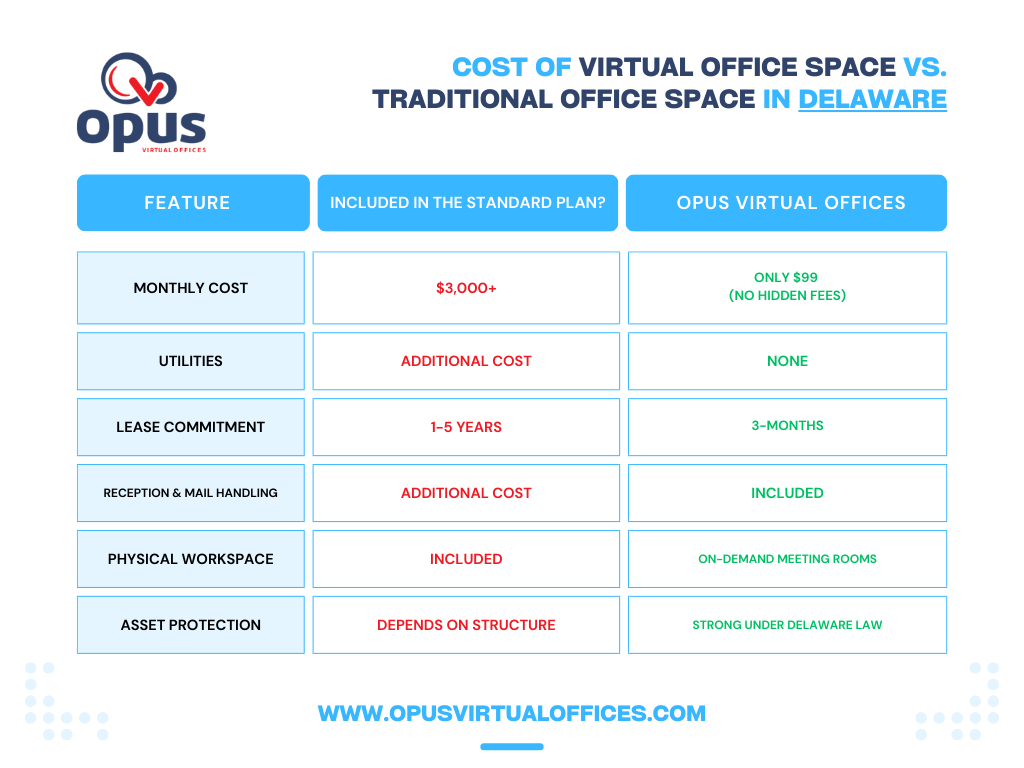

Delaware Virtual Office vs. Traditional Office

FAQs About Virtual Offices in Delaware

Can I use my virtual address as my registered agent address?

No. Delaware requires a separate registered agent, but many virtual office providers offer this as an add-on service (Opus does!).

Will my LLC be taxed if I don’t live in Delaware?

Delaware doesn’t tax out-of-state income. However, check with your tax advisor about rules in your home state.

What’s the difference between a virtual office and a PO Box?

A virtual office provides a real street address you can use for legal registration, banking, and business licensing—PO Boxes are not valid for these purposes.

Ready to Set Up a Virtual Office in Delaware?

For less than the price of a single utility bill, you can establish your LLC in one of the most respected legal and tax environments in the country.

Opus Virtual Offices offers a full-featured Delaware business address, mail handling, live receptionist, and everything you need to launch confidently.

Get your Delaware virtual office today—and join the thousands of smart businesses already doing the same.